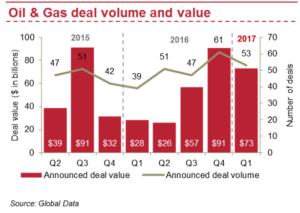

Investor interest in U.S. oil and natural gas soared in the first quarter of 2017, as measured in mergers and acquisitions.

The professional services firm PricewaterhouseCoopers reports $73 billion in announced deals for the quarter, representing a striking 160% increase in deal value compared to results in the first quarter of 2016.

That’s a record high for oil and gas deals in the first quarter of any year since PwC began tracking such activity in 2002.

“Pleased by a pro-energy policy agenda taking shape, reassured by the relative steadiness of the price of oil, and encouraged by advances in shale technology, investors entered 2017 with renewed optimism,” PwC says in a report released April 20.

The surge was driven by the upstream segment, with the Permian Basin in Texas and New Mexico continuing to stand out. In all, PwC cites 20 deals in the Permian valued at $21.3 billion, a record high for the basin.

The burst of M&A activity followed a trend that began last year, when deal-making started off slowly but picked up momentum as commodity prices stabilized and capital markets thawed.

PwC’s report for 2016 showed 198 oil and gas deals worth $195.7 billion, about even with the prior year.

Will this momentum continue? PwC isn’t sure.

“Although there is still plenty of dry powder, including the capital of foreign investors who are finally beginning to return to U.S. shale plays, we see a few signs that the tide may be starting to ebb,” the report says.

“Commodity price declines midway through the first quarter, coupled with declining oil and gas equity indices have given potential buyers reasons to revisit their valuation assumptions.”

Meanwhile, U.S. electric power assets continue to hold an allure for Canadian companies looking to offset diminished opportunities for growth in their own country.

Among the latest examples is the purchase of WGL Holdings by AltaGas Limited, a diversified energy company in Alberta concentrating increasingly on growing natural gas and renewable-energy production.

The $6.6 billion acquisition is the biggest among North American power and utility deals recorded by PwC for the first quarter of 2017, and one of two mega-deals (worth more than $1 billion) for the period.

The combination of AltaGas and Washington, D.C.-based WGL, which owns gas utilities in the U.S. capital, Maryland and Virginia, results in an enterprise worth $17 billion, including $3.4 billion in revenue linked to regulated rates.

“The entity is expected to have an ability to target high-growth markets and enhance its clean-energy offering to customers, while maintaining a significant presence in Washington, D.C.,” PwC said in its April 20 report.

The other mega power deal for the first quarter also involves Canadian interests.

Alberta Investment Management Corp. combined with Arlington, Va.-based AES Corp. and other investors to acquire Sustainable Power Group, the largest independent owner, operator and developer of utility-scale solar assets in the U.S., from Fir Tree Partners for $853 million in cash and the assumption of $724 million in debt.

The deal is expected to close in the third quarter of 2017, PwC said.

“There is a lot of growth opportunity in the U.S., and the regulatory construct in the U.S. is attractive,” Jeremy Fago, the leader for the PwC unit that tracks U.S. power and utilities deals, told me in an email.

The Canadian interest in U.S. power infrastructure came amid robust merger-and-acquisition activity in North America, with PwC recording 71 deals worth $156.6 billion in 2016, marking increases of 51% and 134%, respectively, compared to the year before.

With demand for electricity in the U.S. stagnant and the price of power persistently low, utilities are looking for better economies of scale through consolidations with other operators, especially in regulated markets, where rates of return are more or less assured.